You just finished a fantastic client meeting. You connected, you built trust, you laid out a brilliant financial plan. You’re riding high. And then… you get back to your desk.

That high feeling evaporates pretty quick, doesnt it? It's replaced by the looming dread of the post-meeting grind. Transcribing your scribbled notes, updating the CRM, drafting that follow-up email, creating tasks. It’s a mountain of admin work that, honestly, is the least favorite part of the job for most of us. For years, we've just accepted it as the cost of doing business. But what if it wasn't?

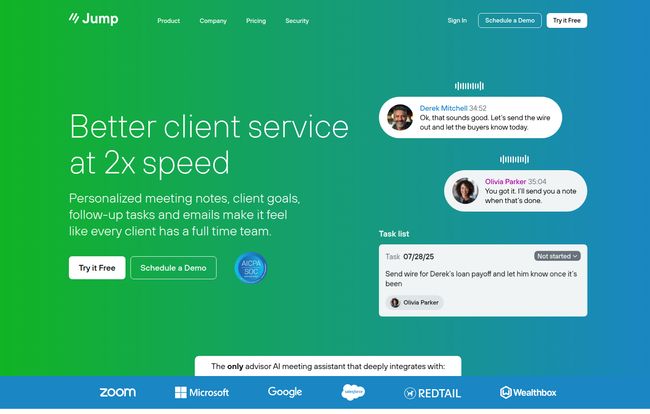

I’ve seen a ton of AI tools pop up, all promising to change our lives. Most are just fancy wrappers for ChatGPT that don’t really get the nuances of our industry. But then I came across Jump. And I’ve gotta say, this one feels… different. It’s built from the ground up exclusively for financial advisors, and it makes a pretty audacious claim: to cut meeting admin work by up to 90%.

A 90% reduction? That’s either marketing fluff or a genuine revolution for our workflow. So I decided to take a closer look.

So, What Exactly is Jump? (And Why Should You Care?)

Think of Jump not as a simple recording app, but as a hyper-efficient, compliance-aware assistant who sits in on your meetings. It records and transcribes the conversation, sure, but that’s just the starting point. Where it gets interesting is what it does next.

This isn't just about getting a wall of text. Jump is designed to understand the context of an advisory meeting. It intelligently pulls out key details, client goals, and, most importantly, actionable tasks. It then takes those insights and pushes them directly into the systems you already use every single day. We're talking about turning a 40-minute meeting into a fully updated CRM record, a drafted follow-up email, and a populated to-do list in about 2-3 minutes. That’s the core promise.

Visit Jump | AI for Financial Advisors

The Features That Actually Matter to an Advisor

A long list of features is one thing, but which ones actually move the needle in a busy practice? After digging in, a few things really stood out to me as being more than just bells and whistles.

Beyond Transcription: Notes That Understand Your Business

We've all seen AI summaries. They're often generic and miss the point. Jump is different because you can customize it to your style. You can teach it what to look for, how to structure notes, and what's important to you and your firm. It can pull data into tables, identify goals, and create summaries that you can actually use without spending 30 minutes rewriting them. It's the difference between a raw transcript and genuine meeting intelligence.

The Holy Grail: Seamless CRM Integration

This, for me, is the absolute killer feature. Jump deeply integrates with the big CRM players in our space: Redtail, Wealthbox, and Salesforce. This isn't some clunky, export-import dance. It's a one-click update. The AI identifies tasks and notes and then, with your approval, syncs them directly to the right client record in your CRM. I still have mild PTSD from Friday afternoons spent manually copy-pasting notes into a CRM. The idea of that entire process becoming a single click is… well, it’s why I’m writing this.

Prep, Follow-Up, and Everything In-Between

The support doesn't just start when the meeting does. Jump can generate a pre-meeting “one-pager” that pulls key info from past conversations, so you walk in looking sharp and prepared. And afterward, it drafts a follow-up email for you. It’s not a generic template; it’s based on the actual conversation you just had. This closes the loop and makes sure nothing falls through teh cracks, which is huge for both client service and E&O (Errors and Omissions) insurance.

Let's Talk Brass Tacks: The Good, The Bad, and The Pricey

No tool is perfect, and anyone who tells you otherwise is selling something. It's important to look at both sides of the coin before you commit your time and money.

Where Jump Shines (The 'Aha!' Moments)

The time savings are undeniable. If it genuinely saves you even a few hours a month, the ROI is pretty easy to calculate. But it goes beyond that. By automating the grunt work, it frees up mental energy to focus on what clients actually pay us for: advice and relationship-building. And let's not forget compliance. Having a detailed, timestamped record of every meeting, with tasks automatically generated, is an auditor's dream. It transforms compliance from a defensive chore into a natural byproduct of your workflow.

Potential Hiccups and Hurdles

Okay, but it can't all be sunshine and roses, right? Of course not. Firstly, you are placing a lot of trust in an AI. While it's very good, you still need to review its output. You can’t just set it and forget it completely—this is a high-stakes profession, after all. A human touch is still required. Secondly, the price. For a solo advisor just starting out, a tool that starts at $75 per month can feel like a big ask. You have to be confident that the time saved will translate directly into revenue-generating activities. Finally, its greatest strength is also a requirement: you need to be using one of the supported CRMs and meeting software (like Zoom or Google Meet) to get the full benefit. It’s not really a standalone product.

Jump AI Pricing: Which Plan Fits Your Practice?

The pricing structure is pretty straightforward, which I appreciate. They offer a few tiers based on the size and needs of your firm. All prices shown are for annual billing, which gives a 20% discount over paying monthly.

| Plan | Price (Per Full Seat/Month) | Best For |

|---|---|---|

| Ramping | $75 | New info advisors and those just getting started with AI. |

| Core | $100 | Solo advisors and small teams needing core integrations. |

| Scale | $120 | Growing teams that need more collaboration and insights. |

| Enterprise | Contact for Price | Large organizations with custom needs. |

Note: It's worth checking their official pricing page for the most current details and feature breakdowns.

Is This Thing Actually Compliant and Secure?

This was my first question, and it should be yours too. Handing over client conversations to a third-party app is a big deal. The team at Jump seems to get this. According to their site, they are SOC 2 Type II compliant, which is a critical security standard. Data is encrypted both in transit and at rest. They make it clear that your data is not used to train their models. This isn't some consumer app playing fast and loose with privacy; it appears to be built with the security and compliance needs of our industry at its core. It creates an incredible audit trail, which could actually make you more defensible, not less.

My Final Take: Is Jump a Gimmick or a Game-Changer?

Look, I'm naturally skeptical of hype. But Jump feels like less of a gimmick and more of a genuine utility. It’s a tool that doesn’t try to replace the advisor but instead aims to augment them, to take away the tedious work that bogs us down and gets in the way of what we do best.

The deep CRM integration is what elevates it from a “nice-to-have” note-taker to a potential “must-have” platform for a modern practice. Without that link, it’s just another piece of software. With it, it can become the central hub for your entire client meeting workflow.

Is it for everyone? Maybe not. If you’re an old-school advisor who loves your legal pad and has a flawless manual system, you might not see the need. But for any advisor or firm looking to grow, become more efficient, and deliver a better client experience, Jump is, at the very least, worth a serious look. It might just be that unfair advantage you’ve been looking for.

Frequently Asked Questions about Jump AI

1. How does Jump compare to other AI note-takers like Otter.ai?

While tools like Otter.ai are great for general transcription, Jump is built specifically for financial advisors. Its key difference is the deep integration with financial CRMs (Redtail, Wealthbox, etc.) and its ability to understand financial context to create relevant tasks and notes, something generic tools can't do.

2. Is my client data safe with Jump?

Security is a top concern. Jump states they are SOC 2 Type II compliant and use end-to-end encryption. They also have a policy of not using your client data to train their AI models, which is a critical distinction for maintaining confidentiality.

3. Can I try Jump before I buy it?

Yes, they offer a 7-day free trial. This is probably the best way to see if it actually fits into your workflow and delivers on its time-saving promises before committing to a paid plan.

4. Will my clients be weirded out that I'm recording them?

It comes down to framing. Most advisors who use tools like this simply explain it as, “I’m using a tool to help me take accurate notes so I can focus completely on our conversation and not miss any important details.” Most clients appreciate that transparency and focus.

5. What's the difference between a Full and a Lite seat?

A Full seat is for an advisor who leads meetings and needs the full suite of features. A Lite seat is typically for support staff, like a paraplanner or assistant, who may need to review notes or manage tasks but doesn't lead the meetings themselves. It's a more cost-effective way to include your team.

6. What happens if the AI makes a mistake?

The AI output is a draft, not a final document. The workflow is designed for the advisor to quickly review and approve the notes and tasks before they are saved to the CRM. This human-in-the-loop step ensures accuracy and gives you final control.

A Final Thought

The conversation around AI in our profession is often filled with fear about being replaced. I don't see it that way. I see tools like Jump as a way to elevate our practice. By handing off the robotic tasks to an actual robot, we get to spend more time being human—listening to, empathizing with, and guiding our clients. And that’s a win for everyone.

Reference and Sources

- Jump Official Website: https://jumpapp.com/

- Jump Pricing Information: https://jumpapp.com/pricing